estate tax change proposals 2021

Learn How to Create a Trust Fund with a Free Wells Fargo Estate Planning Checklist. If such proposal is adopted the resulting federal gift and estate tax exemption would reduce to just over 6 million as of.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

On September 27 2021 the Build Back Better Act was introduced into the House of Representatives as HR.

. Find Out What to Look for When It Comes to Protecting Your Familys Future. The Tax Assessors office provides a fair and equitable assessment for each property. The House Ways and Means Committee released tax proposals to raise revenue on September 13 2021 which included notable changes to income tax and estate and gift tax.

For this reason individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021. The advice is from an experienced tax lawyer including ways to minimize the. Ad Get the Personal Advice You Need To Start Planning A Living Trust.

Learn The Proven Way To Estate Plan. Educates the public about the property tax system. 5376 by Congressman John Yarmuth.

Ad Learn the 6 Biggest Estate Planning Mistakes Before You Invest in Your Family. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017. Understand the different types of trusts and what that means for your investments.

The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts. In this Boston real estate blog post find out what potential real estate tax changes to expect in 2021. Estate Tax Change Proposals 2021.

I the reduction of the current 117 million gift and estate tax exemption to about 603 million will be effective January 1. Provides information to the public regarding their. Our firm offers many years of experience in estate tax compliance so you can be confident that your clients estate tax returns will be calculated accurately and filed on time every time.

The effective dates in the House Proposal differ. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. To ensure fair property tax bills for all residents properties in the Township are revalued each year many based on an analysis of the real estate market but some by inspection.

Should this bill pass into law it means that. The proposed legislation would cause the increased exemption to expire at the end of 2021 instead of 2025. The 2021 exemption is 117M and half of that would be 585M.

Some of the potential estate-tax reforms share elements of recent Democratic proposals such as the For the 995 Act co-sponsored by several lawmakers like Sen. Instead the exemption would expire at the end of 2021 and beginning in 2022 the Federal Estate Tax will be reduced to 5 million. Get A Personalized Roadmap To Create A Thriving Practice That You Love.

Ad Create Your Dream Law Practice. March 23 2021 In the daybreak after another senseless loss of life from gun violence Piscataway Township officials renew their calls on Congress to pass significant and overdue. Work Less Earn More.

In recent weeks this. The proposal seeks to accelerate that reduction.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The Infrastructure Plan What S In And What S Out The New York Times

Biden Budget Biden Tax Increases Details Analysis

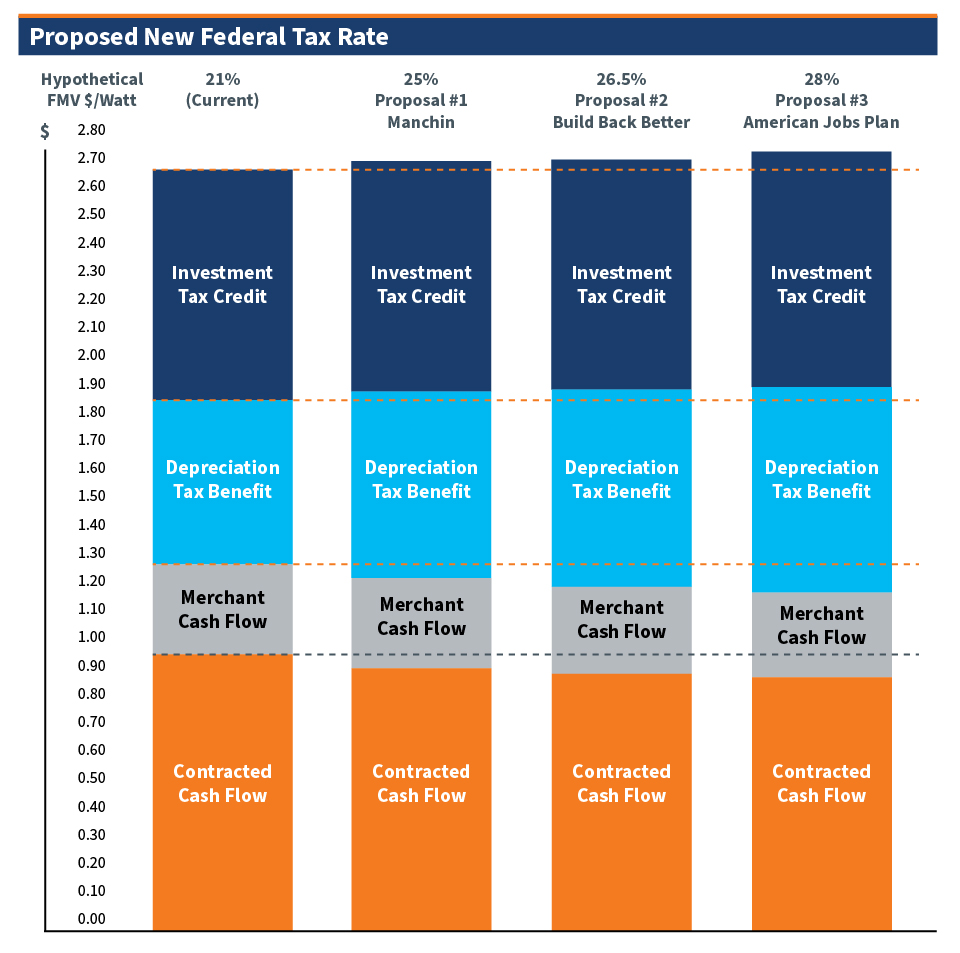

What Do Federal Tax Proposals Mean For Solar Valuations

Tax Proposals Comparisons And The Economy Tax Foundation

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

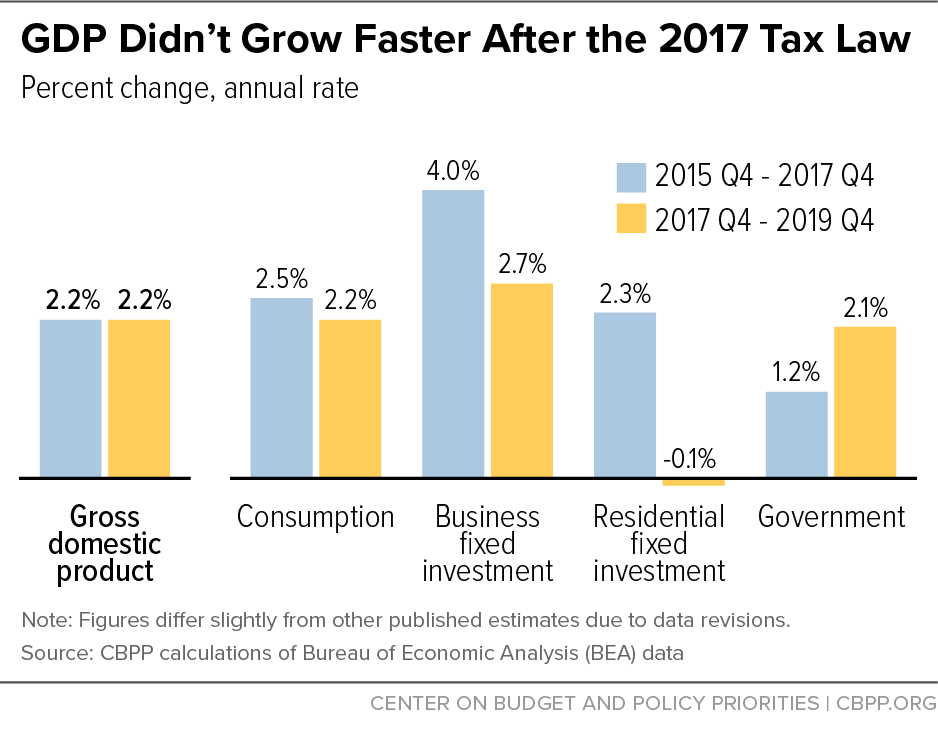

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

Irs Proposes New Rmd Life Expectancy Tables To Begin In 2021 Periodic Table Nerd Life

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

House Ways And Means Committee Tax Proposal

Reasons Why You Might Want To Pay Your Points On Your Mortgage Financial Education Personal Finance Financial Literacy

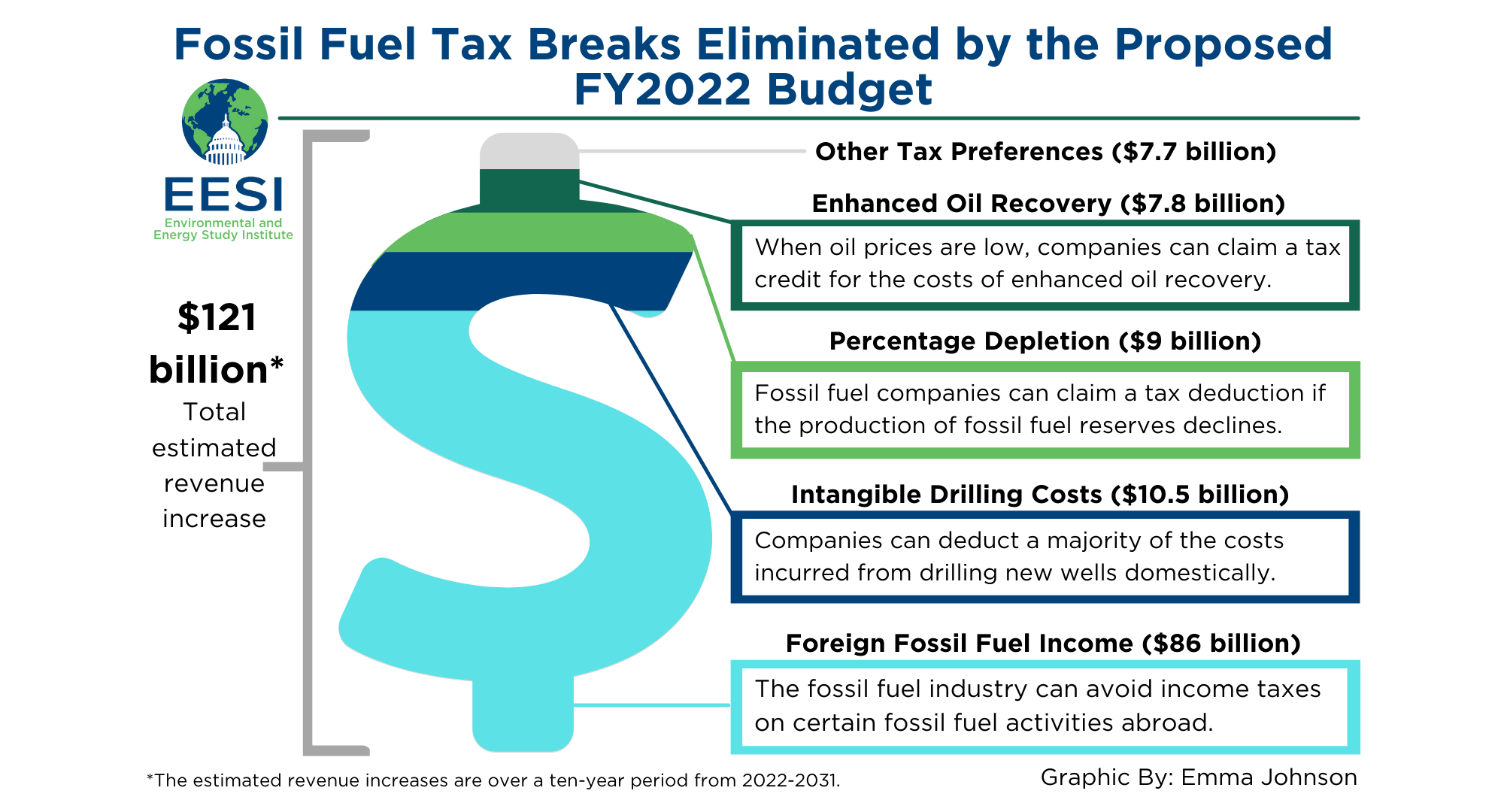

Fact Sheet Proposals To Reduce Fossil Fuel Subsidies 2021 White Papers Eesi

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg